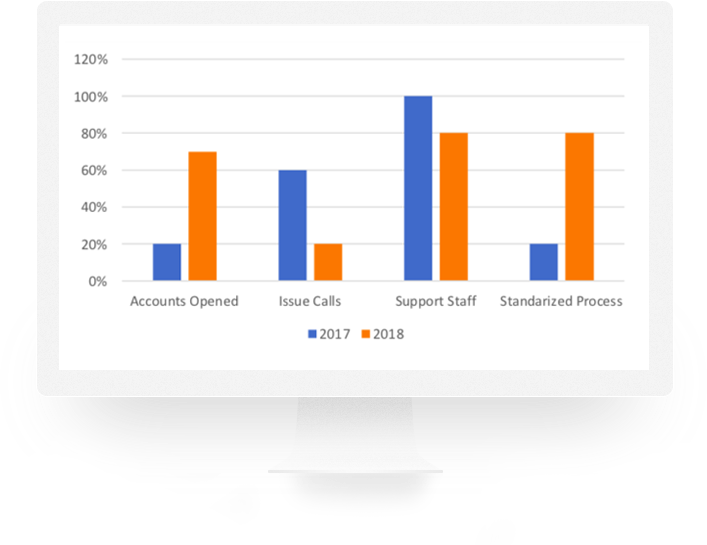

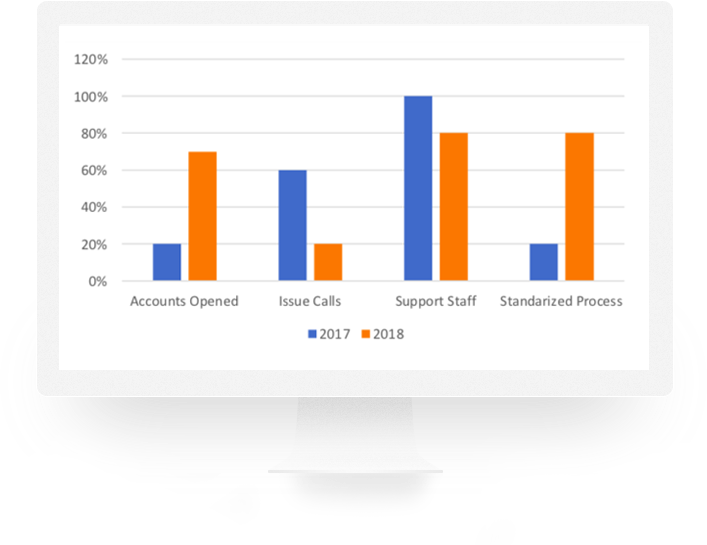

After understanding various challenges and difficulties faced by the team, we, at Perapsis took it as an opportunity to solve these problems. Before working on the solution, we needed to understand the current core problem and related numbers for instance. Number of accounts opened, no. of issue calls, types of issues raised and others.